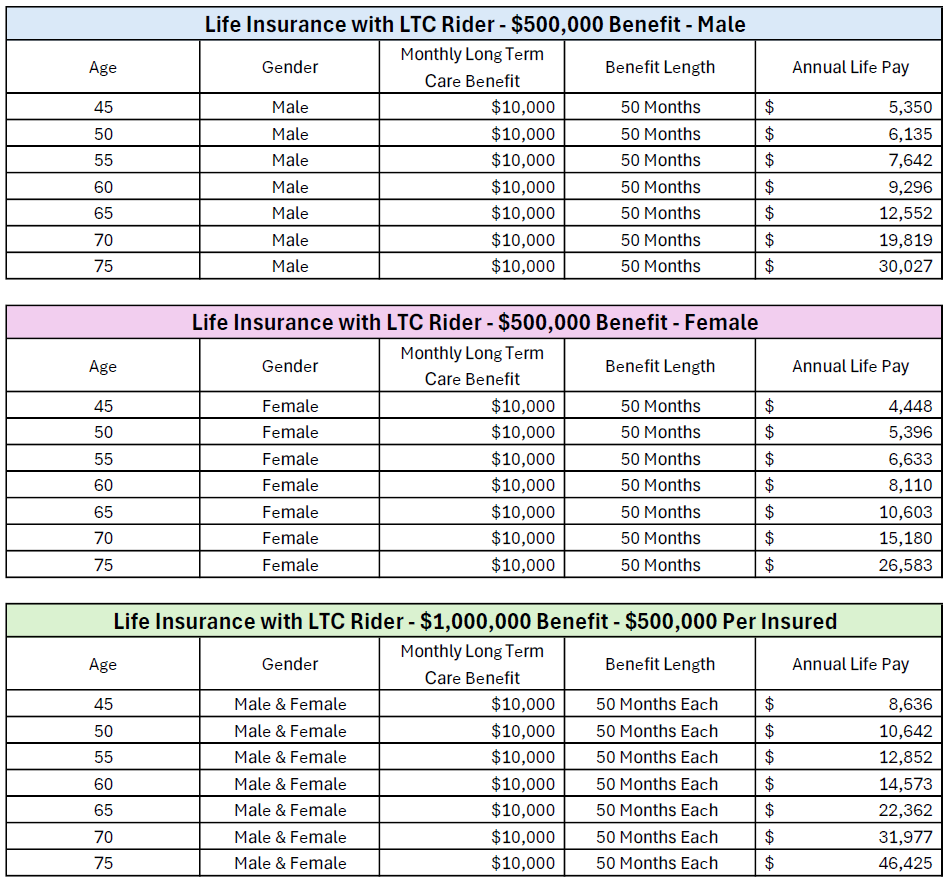

Sample Pricing for Life Insurance with a Long-Term Care Rider

Curious what life insurance with long-term care benefits might cost? The examples below show realistic pricing for permanent life insurance policies with a built-in LTC rider, based on a $500,000 death benefit and a $10,000/month long-term care benefit.

This type of policy allows you to access your life insurance benefit early if you need care — typically 50 months — and whatever you don’t use for care is paid to your beneficiaries as a tax-free death benefit. These policies provide a flexible way to protect both your care needs and your family’s future.

Premiums are shown as annual payments and vary by age, gender, and benefit level. Joint policies are available, with shared benefits split between two insured individuals. These rates are sample estimates and may vary based on your health, the carrier, and underwriting results.

To get personalized options based on your situation, you can complete the LTC Health Snapshot form or reach out to me directly.